“The American Republic will endure until the day Congress discovers that it can bribe the public with the public’s money.” – Alexis de Tocqueville, misattributed

I had the extreme displeasure of reading Paul Krugman’s latest excretion today. He begins by complimenting (nay, sucking up to) the Greek people and ends by making a specious claim about the relationship between a strong central government and the success of the dollar vs. the Euro. He’s clearly not even trying to make a cogent argument anymore. I am neither a Nobel laureate nor a syndicated New York Times columnist, but I will try to respond in kind, by frothing at the mouth and seeing what comes out.

First off, I am able to begrudgingly come to common ground with Mr. Krugman on some points: One, that the Euro is responsible for Greece’s woes. Mr. Krugman, like George Soros, is right that the Eurozone is a terrible idea in the way it’s currently constructed. As a friend of mine recently emailed me, “Where were all these people 15 years ago when the Maastricht Treaty was signed? How did ANYONE think a monetary union without a fiscal union could work?” Two, Mr. Krugman is right that austerity has been devastating for Europe. He gets no points for making obvious statements. Where he gets me every time is his continued advocacy of democratic socialism and big government spending at a time when the consequences of decades of such rampant opportunism and irresponsibility are clearer than they have ever been.

First off, I am able to begrudgingly come to common ground with Mr. Krugman on some points: One, that the Euro is responsible for Greece’s woes. Mr. Krugman, like George Soros, is right that the Eurozone is a terrible idea in the way it’s currently constructed. As a friend of mine recently emailed me, “Where were all these people 15 years ago when the Maastricht Treaty was signed? How did ANYONE think a monetary union without a fiscal union could work?” Two, Mr. Krugman is right that austerity has been devastating for Europe. He gets no points for making obvious statements. Where he gets me every time is his continued advocacy of democratic socialism and big government spending at a time when the consequences of decades of such rampant opportunism and irresponsibility are clearer than they have ever been.

When times are good, people routinely credit whatever proximate cause they can, and for Europe for the last three decades, the cause célèbre has been “democratic socialism.” It is that wonderful post-Stalin Marxist ideal that attempts to solve the historically failed experiment of socialism by putting a friendlier face on it: we’ll do it Marx-style, but make sure we vote for it first. Thus the people retain their political sovereignty and, fingers crossed, economic productivity as well. Although, of course, we know that the economic productivity part is a joke, since it is based on the notion that people are A) fiscally responsible, B) more fiscally responsible in larger groups and C) able to spend other people’s money better than they can spend their own. But we know that when times are good, there’s no problem. Political parties coming to power promising to lower the retirement age, shorten the work week, fund hefty retirements and guarantee low cost loans are always going to win elections against those parties that tout the boring virtues of hard work, discipline and fiscal responsibility.

But then times get bad, and the bill comes due, and austerity hits. No one wants to blame themselves, of course, so they turn to the scapegoats. The most wealthy and productive are a favorite of the democratic socialists. Mr. Krugman gets in on it when he complains about “the arrogance of European officials, mostly from richer countries.” Of course, when Mr. Krugman proposes that European governments continue to spend money they don’t have on social programs and entitlements that don’t work, where does he suggest they get the money if not from richer countries like Germany, that have not only singlehandedly funded the entitlements and social programs Mr. Krugman supports and have prevented much worse austerity which he opposes, but have kept the entire Eurozone afloat?

Europe is not suffering because of a lack of strong central government that can coerce the German people to paying for Spanish mismangement. It’s suffering preciely because it has too much power centralized in the hands of too few, a large central monetary union that has done precisely what Mr. Krugman wants it to do: increase spending in poor countries at the expense and risk of rich countries. The problem is, bailouts don’t work in the long term, and now Europe is just staving off disaster one close call at a time. The markets know the danger of moral hazard and contagion, which is why bond yields in Spain shot up well before Spain was in crisis. And that’s why no one is surprised when Spain’s banks fail, and then Spain has to borrow more money from the EU (read: Germany) to bail out the banks. And when Spain needs to pay off those debts, they will need to borrow more. It’s a pyramid scheme to the tune of hundreds of billions of dollars with the taxpayer money of productive Europeans, people who don’t deserve to have their lifestyles turned upside down by coercion into an economic and political union in which they have no voice. Why should an olive grower in Spain have to pay–dearly–when the Greeks vote for one party over another?

On Sunday, as you recall, there was an election in Greece, and perhaps no time in recent history has so much of the fate of the world economy hinged on one election in such a small country. If anything is needed to demonstrate the folly of this system, it is the idea that 50,000 votes swinging the other way in Greece could have created a global recession. Mr. Krugman wants a bigger political union–a stronger European central government–in order double down on this vulnerability. Why would anybody put power over the economy in the hands of so few? And why would Mr. Krugman, knowing full well the danger of economic collapse, advocate a system whereby economic power is further centralized making a greater collapse even more likely?

And yet Mr. Krugman wants more of that.

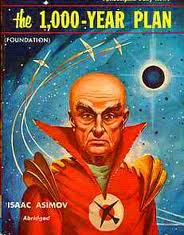

It is hard not to see our current world in the same light. A world that had 800 years of Roman civilization, only to fall into a 1,000 year interregnum, emerging as it did in the 17th century with little knowledge, strength or civility which it has since had to learn. Of course, the Romans were not a perfect civilization, and neither is ours, and neither were any of the civilizations that fall outside the traditional western historical sphere, but I think it can be said for our present civilization that the psychohistorical inertia of mankind has rendered it incapable of truly altering its course, and it is so that we tumble deeper and deeper into the abyss. All through history we have feared the apocalypse, and looking back even 30 years we see the minutes of the Doomsday Clock tick ever closer to midnight as the Soviets played war games, and the surely predicted fall of civilization in the emergence of Islamic terror, financial catastrophe and skyrocketing prices in the stagflation of the 70’s. And now we find ourselves precariously in an even worse position, with the institutional levers of our economy collapsing and seemingly nothing that can be done about it.

It is hard not to see our current world in the same light. A world that had 800 years of Roman civilization, only to fall into a 1,000 year interregnum, emerging as it did in the 17th century with little knowledge, strength or civility which it has since had to learn. Of course, the Romans were not a perfect civilization, and neither is ours, and neither were any of the civilizations that fall outside the traditional western historical sphere, but I think it can be said for our present civilization that the psychohistorical inertia of mankind has rendered it incapable of truly altering its course, and it is so that we tumble deeper and deeper into the abyss. All through history we have feared the apocalypse, and looking back even 30 years we see the minutes of the Doomsday Clock tick ever closer to midnight as the Soviets played war games, and the surely predicted fall of civilization in the emergence of Islamic terror, financial catastrophe and skyrocketing prices in the stagflation of the 70’s. And now we find ourselves precariously in an even worse position, with the institutional levers of our economy collapsing and seemingly nothing that can be done about it. At this point, we’re just kicking the can down the road. And one of these days, there isn’t going to be any bailout money left. Germans will put down their foot. And the country needing the bailout this time is going to be a big player like France or Italy. And no one’s going to be able to pay it.

At this point, we’re just kicking the can down the road. And one of these days, there isn’t going to be any bailout money left. Germans will put down their foot. And the country needing the bailout this time is going to be a big player like France or Italy. And no one’s going to be able to pay it.